Depreciation equation calculator

Depreciation 2 35 million 070 million 10. Total amount of depreciation of an asset cannot exceed its a Depreciable value b Scrap value c Market value d None of these.

Declining Balance Depreciation Calculator

Read more ie the value.

. The Car Depreciation Calculator uses the following formulae. D P - A. According to straight line method of providing depreciation the depreciation a Remains constant b Increase each year.

Determine the initial cost of the asset at the time of purchasing. We plug those numbers into the equation. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered.

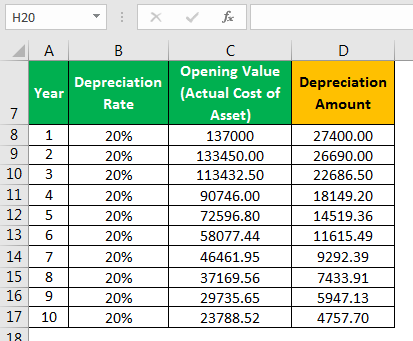

Asset cost salvage value useful life 10000 500 10 950. The average car depreciation rate is 14. Now the accumulated depreciation at the end of year 1 is 7000000 or 070 million.

C Decrease each year d None of them. The following article will explain the. Follow the next steps to create a depreciation schedule.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. For example if a companys machinery has a 5-year life and is only valued 5000 at the end of that time the salvage value is 5000. Its salvage value is 500 and the asset has a useful life of 10 years.

That determines how much depreciation you deduct each year. Determine the salvage value of the asset Salvage Value Of The Asset Salvage value or scrap value is the estimated value of an asset after its useful life is over. A P 1 - R100 n.

The formula for depreciation under the straight-line method can. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating.

Your party business buys a bouncy castle for 10000.

Straight Line Depreciation Formula And Calculator

Car Depreciation Calculator

Depreciation Calculator Definition Formula

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Calculator Hotsell 58 Off Rikk Hi Is

Straight Line Depreciation Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Depreciation Calculator Property Car Nerd Counter

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

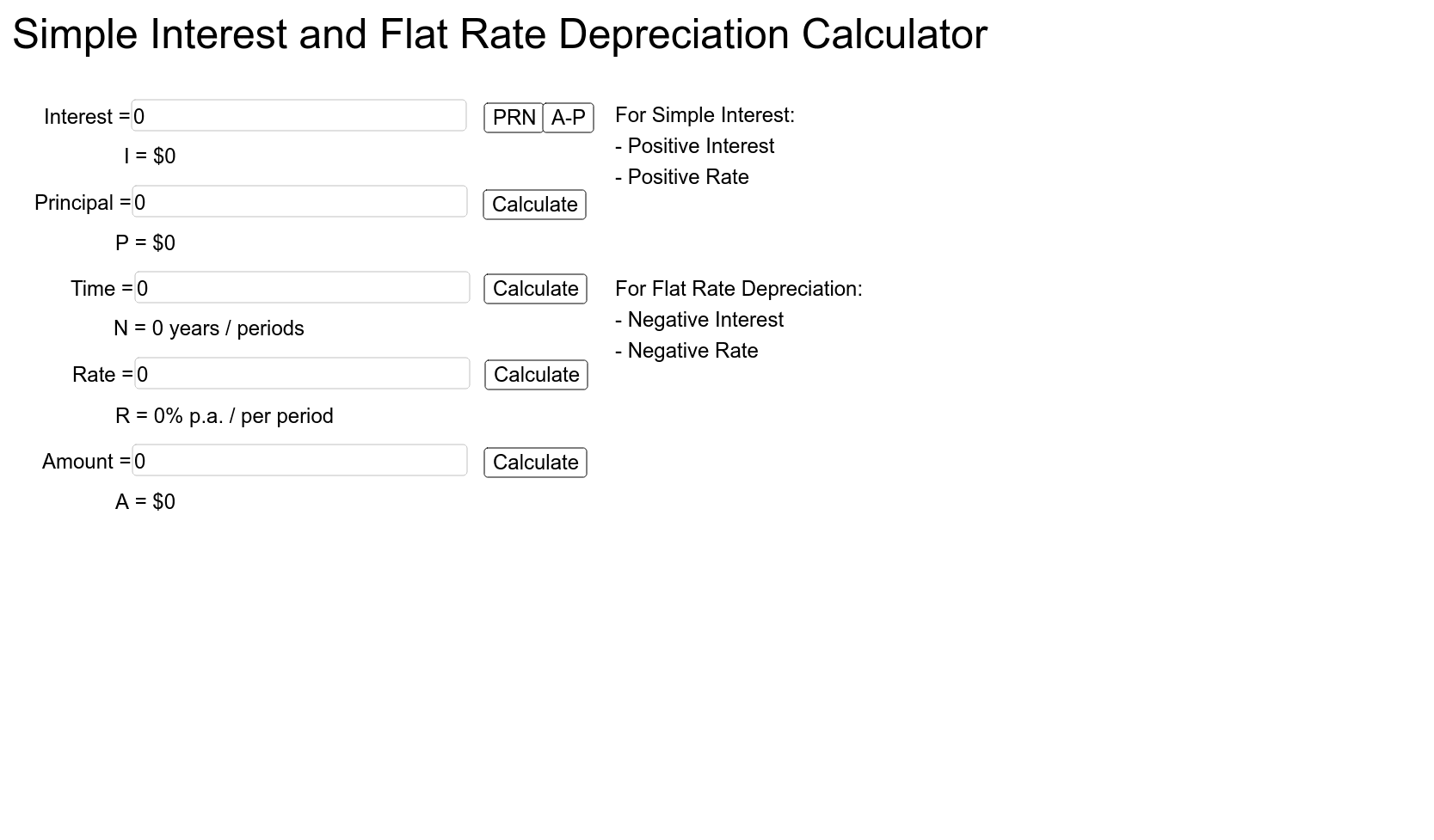

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense